take the stress out of investing and sleep soundly

How did you sleep last night? According to the most recent Financial Stress survey by the FPSC (May 2018), roughly half of Canadians say they have lost sleep over money stress. As the top ranked cause of stress, nearly double the number of people ranked money worries over work, relationships, or personal health. More than half of Canadians felt embarrassed about their lack of control over their finances.

If you’ve been looking for a cure for financial stress-induced insomnia, I have a few suggestions that might help. The keys to taking the stress out of investing are:

1) Find something that’s easy to set up

2) Keep it low-cost

3) Pick something that is passively maintained

No surprise here, I recommend building a passively managed portfolio of Index ETFs that will hold a broad selection of investments at a relatively low cost.

here are 3 options:

Option 1: BuY Index ETFs with a Discount Brokerage (~0.15% Fee)

Model Growth Portfolio

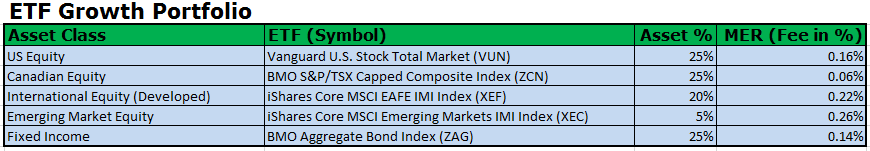

This consists of opening up a brokerage account (like BMO Investorline or TD Waterhouse), then buying ETFs. A typical growth portfolio consists of 25% Canadian Index, 25% US Index, 25% International, and 25% Fixed income. You can re-balance regularly, maybe semi-annually.

The below ETFs are what I happen to own but you can pick and choose your own desired ETFs (iShares, BMO, and Vanguard are the largest providers in Canada).

PROS:

Low cost (fee roughly 0.15%)

Greater control over ETF selection

Can be more tax efficient if held across multiple accounts (RRSP, TFSA, Non-registered)

CONS:

Steep learning curve

Trading fees to buy and sell ($10) - not optimal for small regular contributions

Need to keep track of asset allocation and re-balancing portfolio on your own

Option 2: Buying an All-In-One Asset Allocation ETF (0.22% Fee)

In January 2018, Vanguard released the first all-in-one asset allocation ETF. Instead of buying 4 or 5 ETFs and managing and re-balancing the portfolio yourself, you can buy one ETF which accomplishes the same thing (achieving near market returns). See below for the three Vanguard all-in-one solutions:

Source: Vanguard Canada website: https://www.vanguardcanada.ca/individual/etfs/about-our-asset-allocation-etfs.htm?cmpgn=PS0117CABAPDS0006

Horizon has also came up with their own all-in-one ETFs which may be better for non-registered accounts. You can read about them here.

PROS:

No need to keep track of ETFs and rebalance on your own

Fees pretty low (0.22%)

Simplified solution

CONS:

Slight learning curve with opening up discount brokerage account and implementing trades

Trading fees ($10), not optimal for small regular contributions

Option 3: Using a Robo-advisor (~0.5% Fee + ~0.15% ETF Fee)

Robo-advisors are relatively new to Canada but are making a lot of waves in the industry as investors seek low cost solutions. Robo-advisors will take your portfolio and invest it into a pre-determined mix of index ETFs based on your goals and risk tolerance, and do all the re-balancing for you. These accounts are easy to set up and relatively low cost. For example, Wealthsimple’s standard fee is 0.5% (plus ~ 0.15% ETF fee). For more information on Robo-advisors, see my article "Robo-advisors: Rise of the Machines". You can also compare the fees between Canadian robo-advisors at this great site www.autoinvest.ca .

PROS:

Very easy to use

Helps you create an appropriate portfolio

Automatic re-balancing

No trading fees, ability to make smaller automatic contributions

CONS:

Higher cost than buying your own ETFs (an extra ~0.5%)

Less ability to customize ETF portfolio

So what’s your sleep number?

If you’re interested in learning more about which option might be right for you and your family, contact me at nhui@vavefinancial.com.