A Choose Your Own Adventure Book - for retirement

Most people think of retirement projecting and planning as extremely boring......well....it can be. Especially if the whole exercise is about whether or not (or when) you can retire. But I feel that projecting your future situation can be re-framed as something much more exciting: It is the first step to your own "Choose Your Own Adventure" book! Do you remember those "Choose Your Own Adventure" books, where at certain key points in the book, you are given the opportunity to decide on what the character should do? "If you decide to go into the cave, go to page 64.....if you decide to wait for help to come, go to page 95.....". Well in life, there are key choices and trade-offs we must all make. These choice and trade-offs are usually with spending/having fun now versus having a more comfortable life later. Should I take some nice vacations with my kids now? Should I buy that sports car? Will I have enough when I am 65 to travel? Everyone wants to know the answer to these type of questions but the only way to really answer them is to take a look at your finances now and how they project out to the future.

Knowledge is the Key to Making Big Decisions

A retirement projection exercise puts you in a better position to make really big life decisions and purchases.

Examples of big decisions can be:

- Buying a house

- Starting your own business

- Taking a job that is more rewarding but pays less

- Having one spouse stay at home to take care of the kids/family

- Deciding whether to pay for your child's education

- Going on a really long vacation around the world!

These decisions should be tied back to what is most important to you and form the basis of where you spend your money. Ultimately, financial planning is about helping people enable their goals. Doing a financial projection and creating various scenarios gives us more information to work with and thus equips us with the ability and confidence to making better decisions!

Inputs and Variables are the Key to Retirement projections

The variables needed for a retirement projection are best demonstrated by an example. The scenario below is based on a fictitious couple Kevin and Winnie, both aged 40:

Retirement age: Kevin: 65 years, Winnie: 60 years

Net Worth: $800,000 home, $160,000 RRSPs, $30,000 TFSAs, $15,000 cash, $400,000 mortgage, $20,000 Line of Credit.

Income: Kevin: $100,000, Winnie: $75,000

Pensions: Kevin: None, Winnie: $50,000 at 60 years old

Expenses: $80,000 pre-retirement, $70,000 during retirement

Rate of Return: Investments 5%, House 2%

Inflation: 2% for both income and expenses

Based on the above inputs, an asset chart and a source of income chart can be created using financial planning software (Snapprojections was used) giving a picture of what their financial situation is moving forward:

This chart shows their net worth from age 40 to 100 based on the variables shown above.

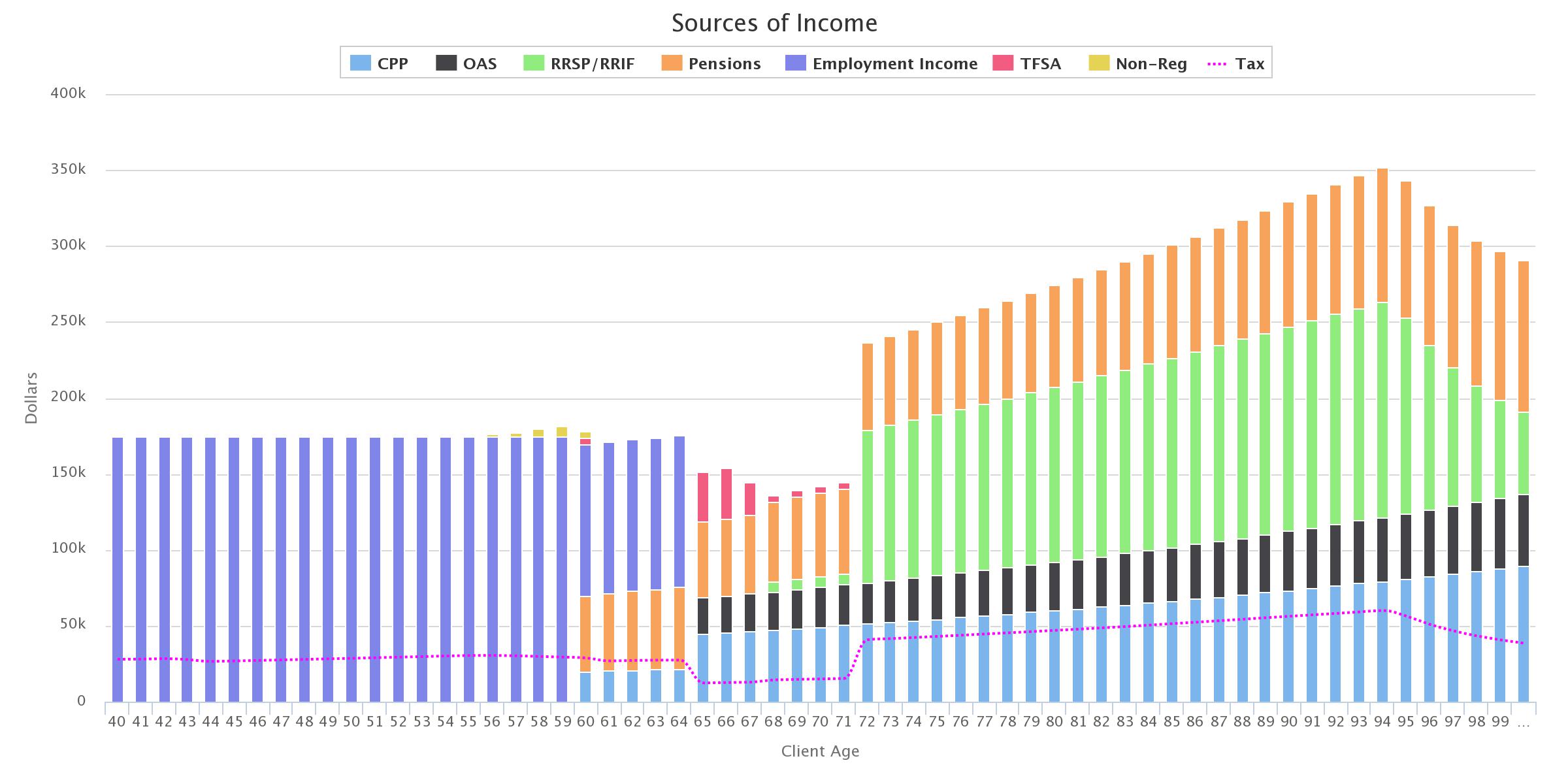

The chart above shows what income source is used each year to pay for lifestyle expenses and debt. Notice that when Winnie retires at age 60, her pension begins to form part of their income. Also not that their future RRSP/RRIF withdrawals are pushing them into a higher tax bracket than when they were working.

This scenario demonstrates the type of retirement projection that can be done to give us a glimpse into what you are on track for. Once we have this base scenario, we can run various scenarios by changing the variables around. For example, we can move retirement age up to 55 and see the impact. We can increase current lifestyle expenses as well (maybe to accommodate for more vacations) and see the impact. Each change in the variables will change the projection, thus allowing you to understand your future situation in relation to your current situation. By doing this exercise, you can see the impact on your future financial picture and therefore how much flexibility there is on your spending now.

So back to my analogy of the "Choose Your Own Adventure" book, this information allows you to potentially increase how much you spend now. Yes we can afford to do X because in the future we will still have enough to do what we want to do then. At the same time, if your projection does not show you can afford to do X now, then you may have to forgo certain now type luxuries. Although it can be discouraging to see that you don't have much flexibility now, would you rather find out now that you can't afford it or when you're 65 years old? Better to know than not to know in my opinion, and the first step to knowing is to have an advice-only financial planner conduct a retirement projection for you to provide you enough information to "Choose Your Own Adventure".

For a list of advice-only financial planners, visit the adviceonlyplanners directory.