I wrote this love letter initially in an article in 2018 as a way to demonstrate the importance of communicating money and other household matters from one spouse to another and it received quite a few likes on social media as the time. I decided to update this letter to 2026 to update some changes and have also added a new visual snapshot that I create for my clients (Which was Inspired by my high school friend that created one for his spouse). Enjoy the update!

*Since this is a public post, details are not actual (account numbers, contacts, etc…)

_____________________________________________________________________________________

Dear Kathy, I love you. You are super smart (and know it) and your witty sense of humor keeps me on my toes. Our kids don’t know how lucky they are having you as their mom. It’s been quite a journey and I’m glad we are always on the same page as parents, focusing on raising them to be strong, independent, and compassionate. I can’t believe they are all teenagers now!

We have been blessed with flexible careers, allowing us to spend plenty of quality time together (including date lunches on Fridays). I am enjoying each moment, and I plan on continuing this journey together. We are however, feeble humans, and a long life together may not be in God’s plan for us. Thankfully, with supportive family and a great network of people that care about us, I am confident you will be cared for emotionally even if something should happen to me.

I’m not great with love notes, but I have and will show my love for you and the kids by ensuring the family is taken care of. Part of that is making sure our finances are in order.

Remember that time you wrote painfully detailed instructions on making pasta in the Instant Pot, even though I probably could have figured it out myself….. eventually? Your caring forethought definitely made the task much easier. Nothing in this letter should be a surprise, since we’ve always been open with our money talk, but I am writing this to help you manage the finances during a difficult time. Hopefully it will make your task much easier too.

How do we pay for stuff?

Bank Accounts:

Our main joint bank account is with Tangerine, which is where paycheques goes into and our household expenses are paid out of. We also have a joint account at TD (where your investments are), and Wealthsimple (where my investments are). I like to keep enough in our Savings account to cover at least 6 months of expenses.

Income:

Aside from your employment income and my self-employment income, our other sources of income come from our Solar Panels and Canada Child Benefit. Both come in as direct deposits into our joint account.

At this time, our income exceeds our household expenses but that would change if something were to happen to me. By my calculation, between our investments and my life insurance (see below), you will have enough to cover this lifestyle expense shortage. In other words, you would not have to return to your job, and can keep your spending the same (unless you want to of course).

With this financial independence, you can focus your energy on raising the kids. Feel free to pick up part time work or hobbies if you want - the key is that you will have the flexibility to choose.

Expenses:

Most of our expenses are paid out from our three credit cards, which we pay off every month. Rogers World Elite Mastercard, Wealthsimple Visa Infinite Privilege, and Scotiabank Amex Gold. Some expenses are paid by pre-authorized debit (like property tax and insurance), while our utility bills arrive in the mail and are manually paid out of our Tangerine account. Our house and car insurance are with TD Insurance and set on autopay.

What do we own?

Registered Investments:

You have your RRSP, Spousal RRSP, and TFSA at TD Direct Investing,, while my RRSP/TFSA are at Wealthsimple. They are all invested in index ETFs in a growth portfolio (75% equity-25% fixed income). Our RRSPs and TFSAs are maxed out to date and you are the beneficiary for my RRSPs and successor holder to my TFSA.

Non-Registered Investments:

You have your non-registered portfolio at TD Direct Investing, while my non-registered portfolio is at Wealthsimple.

Registered Education Savings Plan (RESP)

We recently moved our RESPs to Wealthsimple from Embark (which was a very poor decision at the time going with a Group RESP plan). They are invested in one fund ETFs and are quite conservative as our kids are nearing University age.

Debt

We do not have any debts but do have a Home Equity Line of Credit available with RBC which is secured by our house. Only pull in case of emergency!

Insurance

Our Life Insurance policies are with Ivari (located with our Wills). My policy is for $500,000, while yours is for $250,000. Our premiums are paid by the investments we own within these policies.

Will

If you are unable to locate our Wills, a copy is kept on file at the law firm. There is nothing too complex about my Will. You are the beneficiary, and I have structured most of our assets so they will flow outside of my Estate to limit the amount of probate tax paid. Nerd alert.

Financial Planning - Advice

I was going to write all about how you should invest the insurance money, ways to optimize your income most efficiently to reduce taxes etc… ….but I don’t really want to burden you with any obligation to follow my (probably) outdated advice, nor do I want to manage our finances “from the grave”.

A few years ago, we hired our own advice-only financial planner. During our financial planning process with her, she became familiar with our family finances, so contact her for help!

Usernames and Passwords

Aren’t you lucky! I have a unique password for every single account……surprise! (Not a surprise.)

I’ve shared with you my usernames along with passwords hints. You will need to use these hints to decode my passwords (based on our previously discussed system). This info will be used to tie up loose ends and to help close the accounts.

It’ll be like that escape room we couldn’t get out of….haha

My hope is…

……that you will never have to use this letter and that we grow old and wrinkly, that we get to watch our kids grow up and have their own kids and that we can share in all these beautiful moments together.

In your letter to me, please include those Instant Pot instructions again.

Love,

Nick

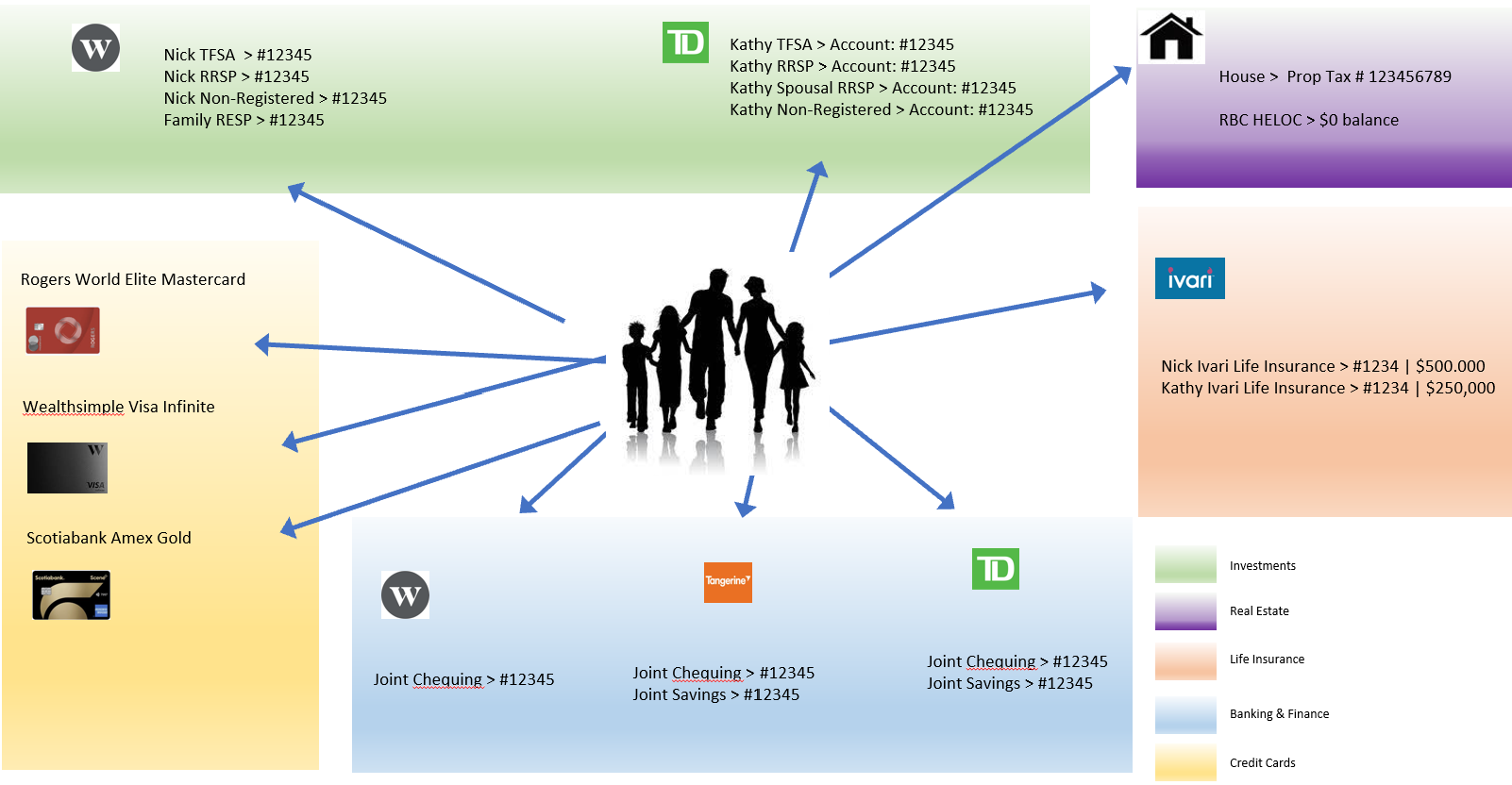

PS: I’ve included below, our Hui Financial Picture Visual to help better understand how everything fits in!

Here is our Hui Financial Picture for 2026